The news love talking about the US housing market at the moment. The housing market enters an awkward phase or recession territory. An Ex-Trump advisor is nervous about it. Even the rich offload luxury real estate in Miami and San Francisco.

Apart from home prices, analysts mention things like inventory levels, mortgage rates, long-term interest rates, housing starts, and more. So what are all those numbers, and where do they come from? And how do they help you predict a potentially coming crash in the US housing market?

Below we’ll look at 13 house market indices, grouped by prices, sales, inventory, construction, and borrowing costs. For each index, I’ll point you to the source: where you can find the original data.

Let’s start with prices.

House prices

Want to know how the housing market is doing? An obvious starting point is the question: are prices going up?

For example, you might compare the prices of today to the previous month, or the same month the previous year—to make sure there isn’t some “summer effect” at work, for example.

When looking at house prices to figure out where the market is headed it’s important to look at the fine-print. For example:

- Who is buying? Average sales prices might go up because richer folks upgrade their houses. Many indicators use a variant of the “repeat-sales” method to prevent this from being a problem.

- Seasonal changes: summer time is typically stronger than winter-time, so make sure to compare apples with apples, not with dirty dishes

For house prices, there are two major indices to look at, the FHFA House Price Index (HPI) published by the US federal government, and the CoreLogic Case-Shiller Home Price Index published by Standard & Poor, a rating agency.

FHFA House Price Index (HPI)

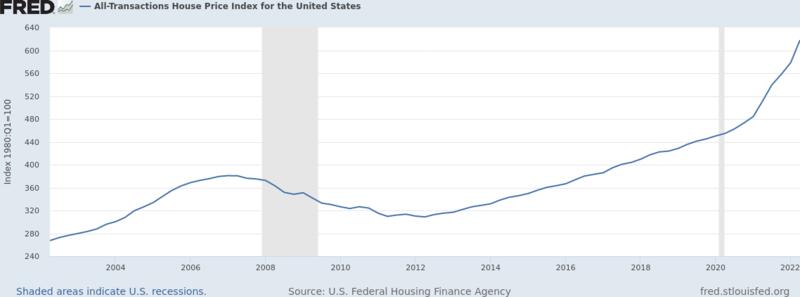

The House Price Index of the FHFA, a federal US government agency, looks at repeat sales of single-family homes using mortgage data.

The HPI is actually a whole bunch of indices. For example, the FHFA publishes monthly and quarterly data, they publish them seasonally adjusted and unadjusted. They publish them for the whole of the US, by census areas, states, etc.

What does “repeat-sales” mean? It means they look at for how much more (or less) houses sold compared to the previous time the same houses were sold. (That’s a way to find out if the houses themselves got more expensive, or if people just choose to buy higher-value houses.)

What’s the FHFA? Seems like there is a federal agency for everything, and sure enough there is one for financing your home: The Federal Housing Finance Agency. Among (presumably) other things they track house prices, but with a few caveats:

Good to know: The FHFA uses mortgage data from Fannie Mae and Freddie Mac. That means their analysis only look at mortgages that are purchased or securitized by these two organizations.

And, the index includes only “single-family detached homes”. If for example, you’re interested in commercial real estate, then this price index does not help you at all. Furthermore, quoting it’s technical paper, it excludes:

mortgage transactions on attached and multi-unit properties, properties financed by government insured loans, and properties financed by mortgages exceeding the conforming loan limits determining eligibility for purchase by Freddie Mac or Fannie Mae

And of course it also excludes cash-only purchases.

Still, because you can compare the index to the previous month or year-over-year, it’s an important metric to look at if you’re interested in the US residential housing market.

Where to find the original data?

- Website of the FHFA House Price Index

- Latest reports if you want to look at the press releases and such

- HPI datasets gives you the raw data as CSVs and spreadsheets <3

You can also find the FHFA HPI at the FRED tool of the St. Louis Fred. Here, for example, the last 20 years for the national “all-transaction“ index:

S&P CoreLogic Case-Shiller Home Price Indices

For the US housing market Standard & Poor compiles the S&P CoreLogic Case-Shiller Home Price Indices. They have three big indices, the important one being this:

The U.S. National Home Price Index (Ticker: SPCSUSA) looks at the change in house prices of single-family homes all over the United States. Like, FHFA they use the repeat-sales method, i.e. taking into account inflation, that the building may have been neglected, etc.

What is Standard & Poor?

Standard & Poor is a rating agency. You might hear about them in the news, for example when they downgrade a country. Their job is to look at something and figure out what it’s worth. Apart from countries, they also rate companies, industries, equity, “digital assets”, and a lot of things inbetween. For example, they’re the ones compiling the famous S&P 500 large-cap index that’s behind your VOO Vanguard ETF. Oh, and they also look at real estate prices.

The S&P index is updated every month, using a 3-month average. Its release lags by two months, so end of July they’d release house price changes that include May. (Hey, same as the FHFA report, what a coincidence!) And it’s not seasonally adjusted, so sometimes prices can be down simply because it’s that time of the year.

How does S&P calculate the index value? Quoting them:

CoreLogic receives sale price information from multiple sources and crosschecks data points using its own proprietary methodology.

So, it’s a secret and might be much better than the FHFA index, or total garbage. The press seems to trust that one, but what does that mean. ;)

Where to find the original data?

Unfortunately, to get the raw data, you’ll need to register. It’s a rating agency after all.

If you only need a graph, the FRED tool of the St. Louis Fed provides a graph for this index, under the CSUSHPINSA series. Here for the last 20 years:

Note that S&P also builds a bunch of other indices, for example the S&P CoreLogic Case-Shiller 10-City Composite Home Price NSA Index. It tracks single-home prices in the 10 largest metropolitan areas, for example areas around New York City, Boston-Cambridge-Quincy, Denver, Las Vegas, etc.

FHFI vs S&P Case-Shiller

If you’re wondering what the difference is between these two indices, this Seeking Alpha article may be of service: FHFA And Case-Shiller Home Price Indices: What’s The Difference?

Sales

The 2nd big category of residential housing indices covers sales numbers: how many houses are being sold or are on sale?

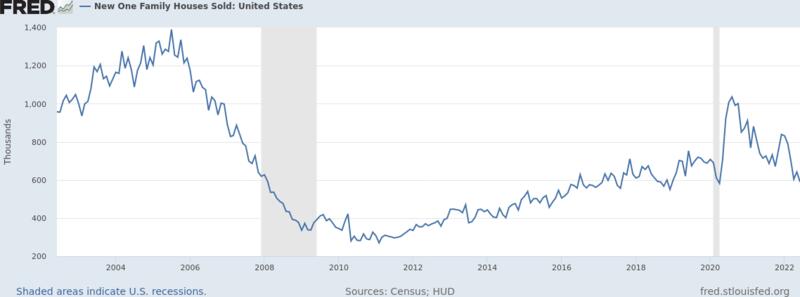

Sales of new single-family houses (by USCB and HUD)

The US Census Bureau and the Department of Housing and Urban Development (HUD) conduct a regular survey. Based on this survey, they jointly release a monthly report that gives you an estimate of how many new single-family have been sold that month, adjusted for seasonality.

Note this is about new houses, not re-sales.

What do higher sales mean? Let’s say the number goes up—more houses are being sold. This might mean more people want and can afford to buy. If demand is rising then prices should be rising, too. But, if before there were not enough houses for sale, and now there are, then prices will fall—supply is catching up with demand. So, higher sales numbers really need to be read in context.

Trivia: cruising for you

Their FAQ has this interesting tidbit. For areas where they can’t get data on construction by asking permit-offices:

roads in sampled NP areas are driven as least once every 3 months to see if there is any new construction

If you’re US-American: That’s your tax dollars on a cruise! :D Love this kind of trivia? Check out their page on how they collect their data.

Where to find the data?

- website of the monthly and quarterly “New Residential Sales” report, including new single-family house sales

- latest release including sales is here

- If you want an easy graph with historic data, check out the HSN1F series by the St. Louis Fed’s Fred tool. Here is the graph for the last 20 years.

(Pending and realized) sales of existing homes (by NAR)

The National Association of Realtors (NAR) publishes a report on existing home sales.

They publish slides each month, but no historic data. The data includes existing single-family homes, condos, and co-ops. The pending sales should be a nice leading indicator.

Where to find the data?

Can’t share a graph with you, because they unfortunately don’t allow anyone to reprint anything … which seems a bit odd, given that they’re supposed to promote the industry?

Inventory: houses for sale

How many houses are for sale at the moment? And more importantly: how is this number changing? If it keeps going up that means folks aren’t buying fast enough, and prices could go down.

Note this is about new houses, not re-sales.

It’s important to then look at why those numbers are going up. Here are a few questions you could ask:

- Looking at the previous indicator: Are sales numbers steady, i.e. are as many people buying houses like before? Then it means that too many houses are being constructed. This will probably solve itself—companies will slow down construction. But, if people are buying less, why is that?

- What kind of houses are there too many of? Just because there are too many houses doesn’t mean that they’re the right kind of houses. For example, you could have way too many appartments and too few houses in a time when people flee cities.

Where do you get the number of residential properties for sale?

New single-family houses for sale (by USCB and HUD)

The monthly “New Residential Sales” report by the Census Bureau and HUD (see above for more info) also contains info on the number of single-family homes for sale adjusted for seasonality.

- website of the monthly and quarterly “New Residential Sales” report, including new single-family house for sale

- latest release including houses for sale

- If you want an easy graph with historic data, check out the HNFSUSNSA series by the St. Louis Fed’s Fred tool. Here is the graph for the last 20 years.

Time on the market (by Realtor.com)

How long does a house stay listed before being sold? Realtor.com publishes that data monthly since July 2016. Of course, the faster houses sell the hotter the housing market.

Construction

How is the house construction sector doing? How much money is being spent on building, how many houses are built or planned? That gives us insight into the confidence of the home builders, but also about how many new houses will be available in the future.

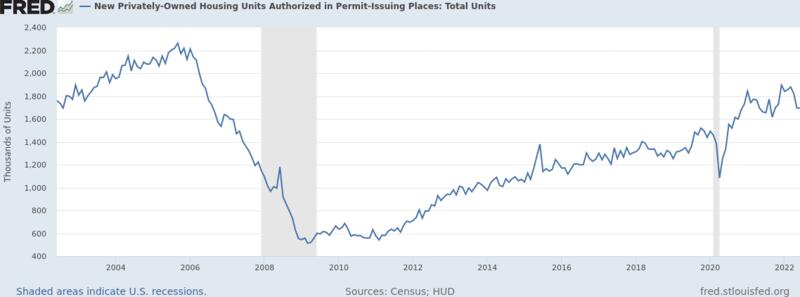

Building permits for new, privately owned (by USCB and HUD)

When home builders have confidence that they’ll be able to sell the units they build, they’ll build many. And before they can, they’ll often have to apply for a permit to build. If they’re concerned that they won’t be able to sell their inventory, they’ll scale back new projects.

A decrease in building permits also means a decrease in housing supply down the line.

That’s why “building permits” are often a tell-tale sign of a slow-down in the housing market—and something analysts watch closely. Here a few random articles discussing permits:

- The U.S. economy is shrinking. The Fed’s rate hikes may have only just begun to bite in The Economic Times India

- Rhode Island Now Ranks Last in U.S. for New Home Construction on golocalprov.com

Where can you get data on building permits?

The U.S. Census Bureau and U.S. Department of Housing and Urban Development release a monthly “New Residential Construction” report. It contains an estimate of how many “privately‐owned housing units” were authorized by building permits, including single‐family homes.

- website of the “New Residential Construction” report

- latest release including housing start data is here

A few notes:

- not all houses require a permit, though the USCB says in it’s FAQ that less than 2% of construction happens in non-permit areas

- the numbers are seasonally adjusted

- the numbers are being revised. For example, in this June’s report the May numbers were updated.

As usual, the St. Louis Fed’s Fred tool has a nice graph. Here for the last 20 years:

Housing starts: How many construction projects are begun

Closely related to building permits are “housing starts”—the beginning of new construction projects. Housing starts matter because of the same reason that permits do: they give an idea of the confidence of home builders that they’ll make sales, and they’ll give an indication of how the supply of new homes will develop in the future.

While starts come at a later stage than permits, they’re still an often looked at indicator. Here are some examples:

- Redfin: These housing markets are the most at risk of falling home prices on Fortune.com

- How will housing starts downturn impact the housing market?, by Mortgage Professional America (MPA)

- What a recession would mean for the housing market (Podcast), a podcast on TheMortgageReports.com

Where do you find data on housing starts?

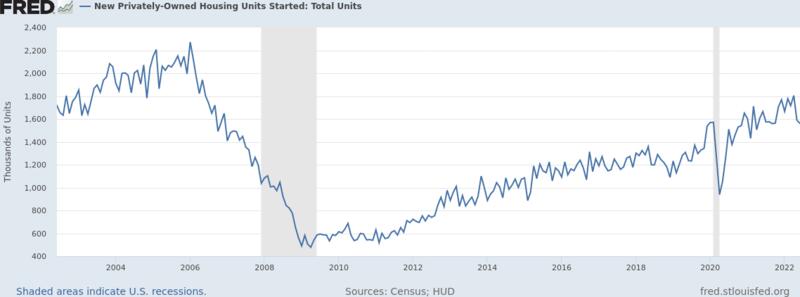

New, privately-owned housing starts (monthly, by USCB and HUD)

The same monthly-released report by the U.S. Census Bureau and U.S. Department of Housing and Urban Development release that details building permits also covers housing starts. Same as above, it contains an estimate of how many “privately‐owned housing units” builders started constructing, including single‐family homes.

Note: numbers are being updated. For example, in this June’s report the May numbers were updated.

- website of the “New Residential Construction” report

- latest release including housing start data is here

As usual, the St. Louis Fed’s Fred tool has a nice graph. Here for the last 20 years:

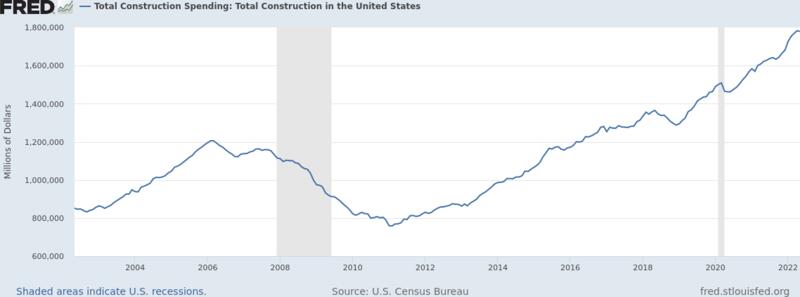

Public and private construction spending (monthly, by USCB)

How much money is being spent on building houses? While this is of course related to housing starts—i.e. how many houses are being built in the first place—construction spending gives a different lense to look through.

For example, if the same number of houses are being built, but spending goes down, that means either costs have decreased for some reason—or cheaper houses are being built.

The US Census Bureau releases a montlhy report cleverly named “Construction Spending”. In it, you’ll find seasonally adjusted estimates how much was spent on:

- private projects, both residential and non-residential

- public projects, separating state and local projects from federal ones

Where to find the original data?

- website of the “Construction Spending” report

- latest release

For a quick graph, see the TTLCONS series of the Fred tool by the St. Louis Fed. Here for the last 20 years:

Home Builder sentiment: NAHB/Wells Fargo Housing Market Index (HMI)

The indicators we’ve looked at so far are plain numbers, even if they are estimates: prices, numbers of houses sold or construction projects started, etc. This indicator is a bit different: it’s about how home builders feel about the industry. The National Association of Home Builders (NAHB) releases a monthly report called the “NAHB/Wells Fargo Housing Market Index” (HMI).

The HMI is calculated by asking people from a number of association members to rate how they feel about present and future sales and current traffic of prospective home buyers. Of these three, present sales are weighted most heavily. Out comes a number between 0 and 100, describing how the members of the NAHB currently feel about things:

- less than 50? not so good

- around 50? neutral

- above 50? positive

A few example numbers:

- June 2005: 72 (pretty good)

- January 2009: 9 (darn miserable)

- November 2020: 90 (life is amazing!)

Read more about this very simple survey in the “Methodology” section of the Index’s page.

- Website of the NAHB/Wells Fargo Housing Market Index

- Chart of HMI with single-family housing starts, as an Excel spreadsheet

Who uses this index? The real estate industry themselves of course, but also mainstream media:

- Housing starts data raises 5th recession red flag by HousingWire.com

- US housing market could be headed for ‘meltdown,’ economist warns by the New York Post

Borrowing costs

Borrowing costs are a leading indicator of the housing market: if it gets more expensive to borrow, fewer people can afford to buy a house, and more people get into trouble with their existing mortgages.

There are two major indices to look at here.

US Federal Reserve Interest Rates

Not technically an index, the interest rates set by the Federal Reserve (the US central bank) are usually the lowest rates in the country—because they’re considered the safest. That means, if the Fed raises its rates, mortgages will rise, too. So, if you’re interested in mortgage costs and thereby the state of the US housing market in the future, then you have to pay attention to what the Fed does.

Where do you learn about rate changes by the Fed?

The Fed announces rate changes in press conferences and press release statements. For example, on July 27, 2022, the Fed increased the rate range to 2.25% - 2.5%.

For historic data, see the St. Louis FRED graphs:

- since December 16, 2008, the Fed used a range:

- lower limit, DFEDTARL series, currently 2.25%

- upper limit, DFEDTARU series, currently 2.5%

- before December 16, 2008, use the DFEDTAR series

Here for example the lower limit, over the last 10y:

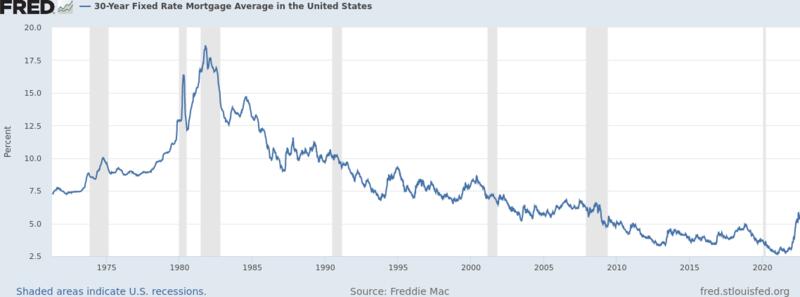

30y fixed-rate US mortgages, and other durations (by Freddie Mac)

The most widely cited mortgage rate is the 30y fixed-rate mortgage average by Freddie Mac. It’s published as part of the Primary Mortgage Market Survey® report.

- Website of the Primary Mortgage Market Survey® (PMMS) on FreddieMac.com

On the website you’ll find a graph tool and historic data as a spreadsheet.

This data series, too, is made easily accessible by FRED, the online tool by the St. Louis Federal Reserve. Here is the graph for 1971 to now—it really puts current rate increases in perspective.