For a long time people have looked at copper prices to figure out how the economy is doing. Copper prices have been so reliable as an economic indicator that economists have been talking of “Dr. Copper”. But why is copper better than other commodities, say nickel or soy, to judge the global economy?

In short

- Copper prices are like a one-number health-check on the global economy.

- The idea: A booming economy demands for more copper, and prices should rise. Economy crashes? Copper demand falls, and so should prices.

- It works because copper is used far and wide in the economy.

- Copper got the “Doctor” title because it’s so good at boiling down the state of the economy to one number.

Can copper prices predict a recession?

Copper prices aren’t going to give you a clear YES or NO if a recession is about to hit. Also, because recessions aren’t a clear cut thing. But they do give you a good sense of what’s going on with the world economy.

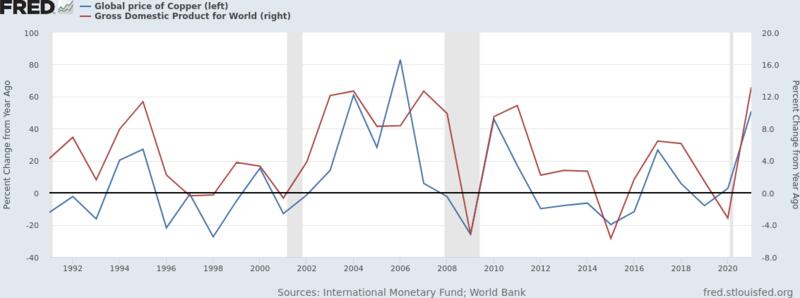

Have a look at the following graph. The blue line shows how copper prices changed year over year. The red line shows the same thing for world GDP—i.e. how the world economy is doing. As you can see they track each other pretty well!

Sources:

- Graph from the St. Louis' Fred tool: https://fred.stlouisfed.org/graph/?g=VUcJ

- Copper prices: International Monetary Fund, Global price of Copper [PCOPPUSDM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCOPPUSDM, November 6, 2022.

- World GDP data: World Bank, Gross Domestic Product for World [NYGDPMKTPCDWLD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NYGDPMKTPCDWLD, November 6, 2022.

There is a word for this behavior, that the copper price follows the economy up and down: copper is cyclical.

Are copper prices a leading or lagging recession indicator?

A leading indicator—because copper prices show slowing demand as it happens.

Why not just look at world GDP then? You could, of course—except copper prices are available faster. To calculate the GDP number of anything you need a lot of data that you can munch together. The current price of Copper is available in real-time.

Dr. Copper isn't perfect

Price changes for copper don’t always mean that people want more or less of it.

For example, if the US puts tariffs on some copper imports, then the price might rise but demand didn’t move one bit.

On the supply side, you can have changes, too. A new mine might start producing, and that new copper makes prices fall. The other way around, a labor strike might shut down a major copper mine for a few weeks, and the price on the market shoots up, but the economy didn’t change.

In other words: it pays to keep your eyes open, and to look at other indicators, too.

Can I use some other commodity instead of copper? For example soy or steel?

The beauty of copper is that it’s used so widely across industries and countries.

That’s great because then copper shows more than just one industry having a problem or doing well—it reflects the broader economy.

Here are the main industries main according to the Annual Data 2021 by the Copper Development Alliance

- building construction: wiring, heating, plumbing, and more

- electrical and electronic products: for example, your iPhone

- industrial machinery and equipment

- transportation equipment, for example that Tesla

- consumer and general products

Why is copper so useful, anyway?

Copper has a few properties that have made it a very useful material throughout the ages.

First, it’s easy to work with: easy to bend and stretch. It protects against corrosion, especially in combination with nickel. It’s also a great conduit for both electricity (copper cables) and heat. And as if that wasn’t awesome enough, it also has antimicrobial properties, which is why hospitals should use it for door handles. (In old times, people noticed that water stored in copper vessels stayed well longer. Read more about it on Wikipedia.)

Where do I find historic and current copper prices?

- Copper spot prices and historic charts for 30, 60 days, 6 months, 1 year, etc. by kitcometals.com

- Copper prices for the last 30 years, by indexmundi.com

- Copper prices adjusted for inflation using CPI (Consumer Price Index), by inflationchart.com

- Graphs with historic copper prices dating back hundreds of years, by winton.com

Read more about copper prices as a recession indicator

- CME Group looks at how copper prices move in relation to the PMI and the S&P 500

- Winton offers an overview of the modern history of copper production.

- The Economist explains why copper prices can rise even in a recession

- Washington Examiner gives us an example how copper prices are used as an indicator in the news

- The National Minerals Information Center of the US Geological Survey (USGS) explains how much copper the United States produces, from where it imports, etc.